Did you know 1 in 2 security cameras installed globally today bears a ‘Made in China’ label? In 2024, Chinese security camera manufacturers dominated 46.6% of the $54 billion global surveillance market – a stronghold projected to extend through 2025 as urban surveillance networks and smart city projects drive unprecedented domestic demand. Giants like Hikvision, Dahua Technology, Uniview, and Tiandy Technologies aren’t just manufacturing devices; they’re engineering an AI-powered surveillance revolution with 4K/8K cameras, predictive analytics, and smart city integration… that’s redefining industry benchmarks from Dubai’s skyscrapers to Moscow’s tundra.

As Western competitors grapple with production costs, these manufacturers leverage China’s “Made in 2025” industrial policies to deliver 8K cameras at smartphone prices, deploy Arctic-grade systems within 72-hour cycles, and embed predictive AI analytics that anticipate security threats before they materialize. Through this article, we’ll dissect the 5 seismic advantages – from hyperscale supply chains to government-fueled R&D – that make Chinese security camera manufacturers the de facto architects of global surveillance ecosystems.

Security Camera Market Size and Development Trends

China and Global Security Camera Market Size

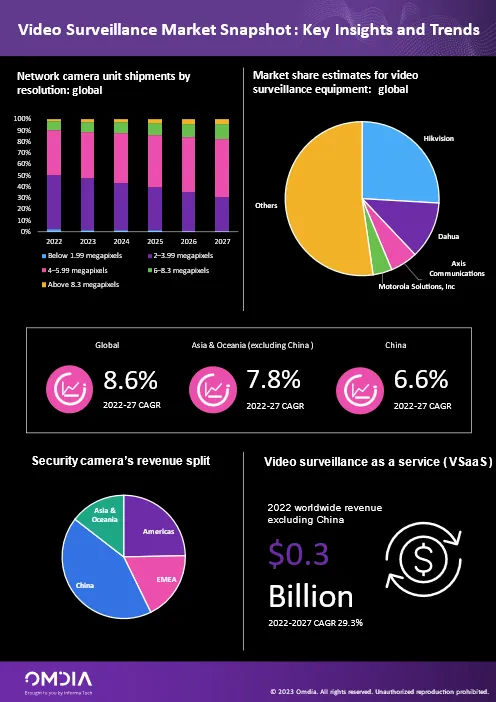

- Global Market: According to the Omdia report, the global security IP camera market was worth $14.73 billion in 2022 (not including China), driven by smart city projects and AI surveillance demand. It is expected to grow to $20.4 billion by 2027, with a steady growth rate of 6.6% per year (CAGR).

- Chinese Market: In 2023, the security camera market in China reached 120 billion RMB. It is predicted to rise to 160 billion RMB by 2025, growing at about 10% each year. Government projects like smart cities and safe cities made up 25% of this market, with over 30 billion RMB invested in 2023.

- Consumer Market: In 2024, China sold 53.49 million consumer-grade security cameras. For the first time, more than half (56.1%) were sold online. High-resolution cameras (8 million pixels) saw sales increase by 6.4 percentage points, and AI technology became much more common.

Security Camera Technology Trends and Policy Support

- Technology Direction: Security camera resolution is improving fast worldwide. In 2022, 50% of network cameras had over 4 million pixels, and by 2027, this is expected to rise above 70%. Chinese security camera manufacturers like Hikvision and Dahua have released products with 8K ultra-HD cameras, thermal imaging sensors, and low-light color technology, such as the ColorVu and WizColor series.

- Policy Drivers: China’s 14th Five-Year Plan supports digital growth. In 2023, the government spent over 40 billion RMB on smart city projects, increasing the need for security cameras. Tax benefits (with VAT rebates up to 70%) and export subsidies also help Chinese companies stay competitive.

Security Camera Regional Market Growth Potential

The Southeast Asian market is expected to grow at 11.2% per year (CAGR) from 2022 to 2027. Africa is the fastest-growing region globally. Chinese security camera manufacturers are entering these markets quickly by offering customized surveillance solutions, like cameras with high-temperature protection and support for multiple languages.

Why Security Camera Manufacturers from China Dominate the Global Surveillance Market

1. Unmatched Scale & Cost Advantages for Security Camera Manufacturers

Chinese surveillance camera companies like Hikvision and Dahua leverage Shenzhen’s hyperscale supply chain to produce millions of OEM/ODM security cameras monthly – equivalent to filling 50 soccer stadiums with devices every year! This massive scale slashes production costs by 25-33% through China’s “Made in 2025” subsidies (SCW). Imagine building cameras at Boeing airplane quantities but smartphone prices. Could any competitor match this pricing power?

2. Tech Innovation: Where Security Camera Manufacturers Meet AI

While Western firms focused on hardware, Chinese manufacturers redefined surveillance tech:

- Hikvision’s 8K cameras detect license plates from 300 meters.

- Dahua’s AI video analytics predict shoplifting through facial recognition and behavioral tracking.

- Tiandy’s Starlight tech sees colors in near-total darkness.

No wonder Hikvision bagged CES 2020’s innovation award – they’re turning cameras into AI-powered sentries.

3. Supply Chain Superpower of Security Camera Manufacturers

Shenzhen’s surveillance hardware ecosystem integrates AI chip developers, lens manufacturers, and IoT sensor suppliers:

- Lens factories ↔ Circuit board makers ↔ AI chip developers

- 72-hour prototype-to-production cycles

- Global shipping hubs moving 10M+ units monthly

This “surveillance ecosystem” lets Chinese manufacturers outpace rivals 3:1 in product launches.

4. Custom Security Solutions: Manufacturers’ Global Playbook

From Dubai’s desert heat to Moscow’s -30°C winters, Chinese firms adapt:

- Arctic-grade cameras for Russian oil fields

- Arabic voice-command systems for Middle East markets

- GDPR-compliant firmware for European clients

With distribution in 180+ countries, they’re not just exporting products – they’re exporting tailored surveillance ecosystems.

5. Government Fuel: How Policy Supercharged Security Camera Manufacturers

China’s $300B “Smart City” initiative created instant demand for 500M+ cameras. Meanwhile, “Made in China 2025” subsidies cover:

- 30% R&D costs for AI analytics

- Tax breaks for export-focused manufacturers

- Joint ventures with Huawei’s 5G networks

Result? Homegrown champions now control 90% of global IP camera production (SCW analysis).

Top 4 Security Camera Manufacturers in China

Hikvision: the largest Security Camera Manufacturer in the world

Hikvision is the leader of the global CCTV market, a 2024 report indicates a 38% global market share, with 2023 financials showing revenue of $12.6 billion and net profit of $2 billion.

Hikvision is operating in over 190 countries. With over 34,000 employees, including more than 19,000 R&D engineers, the company files over 1,300 patents annually. Hikvision’s AIoT strategy, initiated since 2016, integrates AI analytics into products like the DeepinView series with smart traffic monitoring and industrial security solutions, which uses smart learning for enhanced surveillance (AIoT Technologies – Hikvision Global). Their ColorVu technology, highlighted in 2024 trends, provides full-color imaging in low-light conditions, and they’ve developed portable solar-powered solutions for remote monitoring (Hikvision Technology Trends for 2024).

Hikvision launched NVR 5.0 in 2024, revolutionizing AIoT recording, and showcased 8K LED displays at ISE 2025, indicating a move into commercial display markets (Revolutionizing AV: Hikvision Brings 8K LED Centerpiece and Sustainability to ISE 2025).

Dahua Technology: Second-largest Security Camera Manufacturer in China

Dahua, with a 17% market share, reported 2023 revenue of $4.6 billion and net profit of $415 million, calculated from financial summaries.

The global fame of Dahua is evidenced by its extensive distribution networks, with Dahua reaching 180 countries, as per their corporate profiles. Over 22,000 employees, with more than half engaged in R&D, and a broad portfolio including AI, IoT, and digital intelligence platforms.

Dahua are at the forefront of cutting-edge technologies, particularly in AI, IoT, and smart surveillance. Dahua similarly leverages AI for face recognition and night vision, with the WizColor series expanding in 2025 to include categories like WizColor + 4K and WizColor + PT, for retail surveillance systems and public safety networks, enhancing night surveillance capabilities (As Bright As Daylight: Dahua Expands WizColor Product Offerings). Their focus on AIoT solutions is evident in industrial applications, such as digitalization in photovoltaic plants, as per their 2024 ESG report (Dahua Technology Releases 2024 ESG Report).

Uniview: the third largest Security Camera Manufacturer in China

Uniview Ranked as the 6th largest Security Camera Manufacturer globally with revenue of about USD 607 million in 2018, and a strong R&D focus

Over 1,869 patents (94% invention patents), active participation in setting international and national standards. Their Ultra 265 compression reduces storage needs and LightHunter for low-light clarity.

Uniview is focusing on cost-effective AI surveillance for mid-range markets in 2025. Launch of the ColorHunter series for full-color imaging under low light, and expansion of manufacturing capacity with a new base in Tongxiang.

Tiandy Technologies: Offer affordable, high-quality CCTV solutions

Tiandy ranked 7th globally in 2023, with a focus on AI, blockchain, cloud, and big data technologies.

They have over 2,500 employees, with a dedicated R&D institute and a global marketing network, exporting to more than 80 countries. Tiandy excels in low-light Starlight technology and AI-powered solutions. They have a strong presence in smart city and traffic management.

In 2025, Tiandy introduced the “Super Starlight” series for enhanced night vision and new AI-driven security products.

Click here to get more details about the Top 10 CCTV manufacturers in China.

Future Trends: What’s Next for Security Camera Manufacturers?

AI Evolution: Cameras That Think Like Humans

2025 roadmaps reveal shocking upgrades by leading security camera manufacturers:

- AI emotion recognition for crowd management systems and predictive policing algorithms.

- Predictive policing algorithms (Dahua AI Lab)

- Smart home cameras diagnosing plumbing leaks (EZVIZ)

“By 2025, cameras won’t just watch – they’ll understand,” says Shenzhen AI Council’s whitepaper.

Smart Cities: Where Every Streetlight Has a Camera

China’s “Skynet Project” already links 600M cameras to centralized AI. Next phase?

- Traffic cameras reducing congestion by 40%

- Air quality sensors triggering pollution alerts

- Face ID replacing metro tickets in 20+ megacities

Urban planners call it “surveillance-as-infrastructure” – and Chinese manufacturers built the toolkit.

Green Surveillance: Solar Cameras & Eco-Tech

Though niche now, EU’s green tech mandates could make this a $12B market by 2027 (Global Security Report).

Chinese OEM security camera suppliers offer NDAA-compliant solutions and custom firmware development—commanding 46.6% of the global market—leverage hyperscale production, AI-driven innovation (like Hikvision’s 8K license plate detection), and government-backed R&D to redefine surveillance. From Arctic-ready systems to predictive AI analytics, firms like Dahua and Tiandy blend cost efficiency with cutting-edge tech, while “Made in 2025” policies fuel smart city megaprojects linking 600M+ cameras. Why navigate this complex landscape alone?

ICSEECAM, a leading IP camera manufacturer in China, streamlines global procurement with bulk pricing, TELEC/NDAA compliance, and tailored solutions—whether solar-powered units for remote sites or GDPR-ready firmware. Ready to harness China’s surveillance revolution? Email [info@icseecam.com] or visit [icseecam.com] today. Let’s transform your security strategy with innovation that’s not just manufactured—it’s engineered to outthink threats. Your global edge starts here.